Hyacinth Levy Homes

Welcome To The Hyacinth Levy Homes, Licensed Real Estate Dealer Online Real Estate Resource!

Buying and Selling Real Estate in Jamaica: A Guide for Locals and Foreigners

Introduction:

Jamaica is a beautiful country with a cosmopolitan culture. This rich cultural landscape has created an almost insatiable appetite to own property in Jamaica. Prospective buyers fall into three market segments: local residents, the Jamaican Diaspora, and foreigners. Buying and selling real estate in Jamaica is marked by an absence of standardized contract. Thus the process is heavily dependent upon the involvement of lawyers.

The Meaning of Conveyancing:

The exchange or transfer of real estate is known as conveyancing. That is, to transfer or deliver land or property to another or to perform an act that is intended to create one or more property interests regardless of whether the act is actually effective. The usual means of transfer is by deed-written instrument on paper.

Conveyancing can take three forms. A primary or an original conveyance is one in which an estate such as feoffment, gift, lease, exchange or partition is done. A secondary conveyance is one that follows an earlier conveyance and serves only to enlarge, confirm, alter, restrain, restore, or transfer the interest created by the primary conveyance. A voluntary conveyance is one made without valuable consideration.

Other terms that you may come across are:

mesne conveyance- an intermediate conveyance

present conveyance- one that takes effect at once as opposed to the future

conveyancer-a lawyer who does conveyancing

conveyee-one to whom property is transferred is conveyed

conveyor– one who transfers or delivers title to another.

The Five Stages of Conveyancing:

In brief, there are five stages of the conveyancing process:

1. Pre-contract negotiations

2. Exchange of Contracts

3. Pre-Completion Procedures

4. Completion

5. Post-Completion

Pre-Contract Negotiations- Stage 1

The buyer and the seller must work out their respective positions. It is not the duty or role of the lawyer to undertake negotiations. The operative word is KNOW in the context of what you the buyer are buying and what you the seller are selling.

The objective is to arrive at all the terms especially the price and the extent of the property that is being sold and conversely bought. The parties must discuss and agree to any and all conditions such as key dates when contracts are to be exchanged and the completion date.

Exchange of Contracts-Stage 2

After the parties agree upon the terms, then the services of an attorney should be utilized to draw or write the sale-purchase agreement or other modes of transfer. The identities of the parties must be mutually verified. Attorneys should check for conflict of interests before deciding on accepting a party as his or her client. Most attorneys in Jamaica will insist on receiving written instructions from their client.

Buyers would be prudent to perform the followings steps at this stage:

i Secure mortgage commitment pre-qualification or firm commitment

ii Make searches of title records

iii. Pre-purchase inspection- engineer’s report by buyer

iv. Secure insurance to commence on signing contract, if the risk of loss of the property passes on signing contract.

v. Secure deposit

Sellers would be wise to check the buyer’s finances to ensure that the transaction can be completed as intended. In some instances, sellers may decide to finance the transaction and accept a mortgage from the buyer.

After these preliminaries are done, the draft contract is prepared by the seller’s attorney-at-law then sent to the Buyer’s attorney-at-law for review. The buyer’s attorney may at this stage request amendments to the agreement. Upon the resolution of all terms, the stage is set for the signing of the contracts and payment of the deposit to the seller or his attorney. We would recommend that the deposit should be no more than 10 percent of the selling price. In addition, the deposit is usually paid to the seller’s attorney. If the deposit exceeds 10 percent of the contract price, then special care must be taken to designate that amount as an additional deposit. It is customary for the vendor’s or seller’s attorney to act as the facilitator of the conveyance or carriage of sale with responsibility for the execution of the pre-completion formalities listed in the stage 3. The completion of this stage is marked by the physical exchange of contracts.

Pre-Completion Procedures-Stage 3

This stage is marked by the following formalities being completed:

i. Agreement is submitted to the Stamp Duty and Transfer Tax Division of the Tax Administration Office- commonly called the “stamp office”- for the assessment of transfer tax and stamp duty payable;

ii. Payment of Stamp Duty as a percentage of the price is split or shared by the parties;

iii. Seller alone pays the transfer tax;

iv. The executed instrument of transfer is accompanied by the original duplicate title for submission to Office of Registrar of Titles to record the new owner and mortgage(s), if any, and;

v. Secure title insurance- optional.

Additional Steps to be taken if Purchase is being Financed or Mortgaged:

1. If part of the purchase price is funded by a third party, that is, the grant of a mortgage, then the buyer or purchaser would immediately take steps to finalize his mortgage arrangements and get a letter of commitment that is presented to the seller’s attorney within the time stipulated in the contract. The buyer pays all fees and duties associated with the mortgage and in due course executes a note followed by a mortgage deed/Instrument of Mortgage. These documents are prepared and presented for execution by the lending institution or mortgagee or its attorney.

2. If the transaction is an all cash deal, then the buyer pays the balance of the purchase price and both parties execute the Instrument of Transfer for presentation to the Office of Registrar of Titles.

The pre-completion procedures are characterized by intensive so-called back office work being done to prepare all the title and mortgage registration documents, e.g. making arrangements for the net transfer of funds between the parties and securing funding of new note and simultaneous pay-off of old indebtedness.

The use of title insurance is relatively new in Jamaica and buyers should consider getting this form of insurance protects against title defects, legal defense costs and indemnity up to the amount of the title insurance.

Completion-Stage 4

This is the stage where all the paperwork is signed and the relevant documents submitted to the Office of the Registrar of Titles. After the transfer is registered, a buyer should arrange for a last minute inspection or walk-through of the property to ensure that the property is in the same condition as it was when the contract was entered into by the parties.

After the transfer is registered, you may now be said to be the owner of the property with or without a mortgage. The time for completion of the first three stages is usually fixed at 90 days. If the transaction or conveyance is a cash sale, it is customary to allow 60 days for completion.

At this point in the sale process, the buyer’s attorney will have prepared letters addressed to the various utilities and land tax office regarding the transfer and for the various utilities to register or commence service in the name of the buyer, now owner. Care must be taken that final utility readings are done on or as soon as possible after the execution of the transfer. Failure by the vendor or seller to do this could result in being billed for use or consumption by the new owner.

Post-Completion or Closing-Stage 5

The buyer’s attorney ensures that the transfer is completed and the duplicate certificate of title is accurate. Further, the title reflects the discharge of any prior mortgage(s) and the accuracy of any new indebtedness or mortgage. After inspection, the new owner is given his certificate of title or a certified copy of the title if the lending institution kept the original certificate of title.

Conclusion:

Conveyancing in Jamaica is attorney driven. Although the process appears to be simple it can be quite intimidating because of the large amount of paperwork involved. Standardized contracts do not exist so you must be prepared to negotiate and draft a satisfactory contract. The time for completion of the sale is usually set at 90 days if a mortgage is involved. The time limit for the completion of a cash based deal is usually set at 60 days.

– Source: http://banjokolaw.com/lawyer/2014/01/29/Real-Estate/Buying-and-Selling-Real-Estate-in-Jamaica-A-Guide-for-Locals-and-Foreigners_bl11476.htm

Real Estate Contributes to Economic Growth

This article was extracted from “Economy records growth”, Jamaica Observer.

The Planning Institute of Jamaica (PIOJ) is forecasting economic growth ranging from 0.5 to 1.5 per cent, for the July to September quarter.

Newly appointed Director General, Dr Wayne Henry, said this is expected after the country recorded a 1.1 per cent outturn for the April to June period.

Noting that economic growth for the first six months of the 2016 calendar year increased by 0.9 per cent over the corresponding period last year, the Director General said the outturn for the 2016/17 fiscal year is projected to range between one and two per cent.

Henry said the quarter’s outturn largely reflected favourable weather conditions which positively impacted the agriculture, forestry and fishing industry; and the positive impact of continued strengthening of the global economy on some industries, notably hotels and restaurants.

Also in the mix were improved domestic demand, consequent on strengthened business and consumer confidence; and increased construction activities associated with hotel developments and expansion works, housing and new office space to facilitate the business process outsourcing (BPO) sector.

Other sectors recording positive outturns were electricity and water supply, up 5.5 per cent; hotels and restaurants, 1.6 per cent; finance and insurance services, one per cent; transport, storage and communication, 0.9 per cent; manufacturing, 0.7 per cent; the wholesale and retail trade, repair and installation of machinery, and real estate, renting and business activities, 0.5 per cent each; and construction, 0.4 per cent.

5 Things Renters Should Know About Owning

According to NAR, for renters who aspire to be home owners, transitioning from an apartment to a house requires a shift in their thinking that they may not be prepared to make. The financial changes that come with owning, the need to consider planting longer-term roots in a neighborhood, and new neighborhood rules are things renters may not be thinking about enough.

As their real estate agent, it’s important for you to be there for your clients when they’re embarking on a life-changing event such as buying a home.

Moving can already be one of the most stressful times in a person’s life, but it may be doubly so for a new home owner. In order to be their most reliable resource, using your knowledge and experience to provide them with guidance, share these helpful nuggets of information with your clients so their transition from renter to owner can be as smooth as possible.

They need to understand how their financial investment is changing. Renters may see an increase in their monthly rent every lease term, but they don’t see exactly where it goes — toward property taxes and insurance, even “luxuries” such as trash pickup. As home owners, they don’t have a landlord who handles all those details, so they need to be ready to juggle the financial responsibilities of home ownership. Have an open conversation with your clients about these changes and the importance of budgeting to make sure they make smart financial decisions during this process.

They need to be happy with their location for the long-term. As a renter, you can bounce around from home to home every year if you want. But when you own a home, you have to stay put — unless you plan on renting it out, which most home owners don’t. Impress upon your client that location is going to play a much more significant role in their future, so they should think about evaluating school districts, access to amenities, and commute time now as they search for their next home.

They may need to abide by new rules. Renters don’t think about possible homeowner association rules they may be governed by, such as trash pickup rules or any curfews or rules pertaining to animals. Make sure to get all the information on neighborhood rules and associations to help your client understand what their new obligations will be.

They’ll need to get into the mindset of an owner. Life as your client knows it is about to change. Once your client purchases a new home, they will no longer have a landlord to tend to their many needs, including lawn care and plumbing. The best way you can help them as their real estate agent is to provide them with contact information for local industry experts. They will eventually need certified specialists ranging from HVAC companies to carpenters to electricians. Let them know they don’t have to do everything themselves.

They should know their neighbors can affect their value. Renters don’t care who their neighbors are as long as they’re quiet (enough). But your client is now going to want to know whether their new neighbors are renters or home owners. This knowledge can help your clients gauge current and future home value in the neighborhood. If the neighborhood consists mostly of rental properties, it is likely a home owner will lose money on their house in the future. Renters do not always feel responsible for maintaining their properties the way home owners do. Property value comes down to curb appeal. Less-appealing neighborhoods often have more-appealing prices, which is not always good for buyers and home owners.

We are one team.

According to Real Estate Board, people are the life of any organization, therefore it is important that team leaders build a strong team, foster camaraderie and ensure their team is effective in delivering, but most important it is a team that wins!

Know your team members – get to know each member of your team well. Knowing the strengths and weaknesses of team members helps to channel their qualities in the right direction.

Utilize team members’ talents – make the best use of your human capital. Some team members may prefer to work on new opportunities; others may be process oriented, assign tasks to them that demand those attributes. As a team leader your job is to ensure your team members are responsible for tasks or assignments that match their skills.

Encourage team spirit – pep talk your team members, encourage them to believe they can accomplish any tasks they have been asked to do. Above all foster a ‘can-do’ environment. Sometimes encouragement is needed to bridge the gap between thinking you can do it and getting it done.

Establish a Team Display Board – use the board to display team monthly targets, team accomplishments, team process chart, team quality standard, team responsibility calendar, pictures and any other accomplishments. This is another factor that will promote team spirit and make team members feel proud of their work and the team they belong to. Remember creating visibility and promoting your team is the key to having a winning team.

Homes will be cheaper in 2015

NEW HOMES

Builders are planning to lower the price of new homes to boost the volume of units sold, which has stood around or lower than 450,000 a year since the recession, to at least 500,000. “In 2015, I expect builders to try to push above that ceiling on new home sales,” Stan Humphries, chief economist at Zillow, told Forbes. “To do that, they’re going to have to sell less expensive homes.”

Visit this site to see provided information: http://www.msn.com/en-us/money/mutualfunds/8-things-that-will-get-cheaper-in-2015/ss-AA85d1p#image=4

Jamaica grabs attention as top option for second home in real estate rankings

According to Realtors® Association of Jamaica (Ms. Irene E Ming-Hughes) Administrative Manager.

Jamaica has edged out Italy as the most popular real estate search outside of the United States (US), says President of the Realtors Association of Jamaica (RAJ), Edwin Wint.

The development coincides with Jamaica’s addition to the US-based National Association of Realtors (NAR) database last year. Since then, local realtors say, interest in the destination from persons searching for second homes and returning residents has escalated.

Through the formal relationship with NAR, local properties are added to listings viewed on Realtor.com, which displays information in 12 languages and reaches some 80 countries.

The latest rankings show Jamaica at number one of countries most searched outside of the US, followed by Mexico, Italy, Costa Rica, The Bahamas, France, Spain, Canada, the Dominican Republic and Switzerland to round out the top. The site quoted data from a research arm, which made its report in April.

Wint says RAJ’s Multiple Listing Service (MLS) is shown on the NAR’s portal and that Jamaica has been the most searched destination outside of the US for the past five months.

“Previous to that we were second to Italy,” he said.

Howard Johnson of Johnson Benjamin & Associates and chairman of the RAJ Multiple Listing Service credited the searches to the listing service.

“My opinion is that we have one of the most developed, successful and organised MLSes in the region; it syndicates many attractive listings to the large real estate portal. In addition, Jamaica is a popular destination for second homes,” said Johnson.

“Obviously, our weather and beaches play a major role in why Jamaica is such an attraction. Many persons have now come to know Jamaica because of our success in sports, our music and the effort by the Government’s initiatives through JAMPRO and the Ministry of Tourism. Many have become repeat visitors and have opted to purchase condos/apartments and/or town houses as either investments or second homes.”

Debra Cumming, CEO of Century 21 Heave-Ho Properties Jamaica, adds that levels of overseas interest in Jamaica are at an all-time high.

Century 21 is currently closing sales of Moon Dance Villas and Moon Dance Cliff in Negril. Moon Dance Cliff, said Cumming, is being bought by overseas investors, while Moon Dance Villas is being acquired by local hotelier Lee Issa. Both properties had attracted overseas interest.

Carlene Sinclair, immediate past president of the RAJ and managing director of Property Solutions Limited, says most of the queries on property through her website are from overseas buyers.

Sinclair spoke with Wednesday Business just as she was heading out to Port Antonia to assess property that a returning couple were interested in acquiring.

The enquiry was made though Realtor.com international.

“The people are returning residents who will be in the island in August. They are coming back to live in Jamaica. They left here more than 30 years ago. They want me to take some pictures of the inside of the house. That’s what I am going to do,” she said.

As to how many of the leads that come through the online portal result in sales, Sinclair said the database does not fully capture information, while Wint said that information would have to asked of individual brokers.

“We are selling, but I can’t tell you the percentage,” said Sinclair, adding that her company receives around 15-20 enquiries each week.

“It does not mean that those 20 people are buying now, but they are engaging you for information. In other words, we are getting a lot of leads. It’s up to us to convert these leads into sales,” she said.

The MLS supports a network of 400 local real estate brokers.

Land Administration and Management Programme

Information provided by: L.A.M.P Jamaica

The Land Administration and Management Programme (LAMP) is a Government initiative to help all owners of land in Jamaica obtain Certificates of Title for their land and to update the information on existing Land Titles.

.

What Is A Title?

A title gives a description of a parcel of land and states the name of the legal owner.

Why Should I get a Title?

- A Title certifies to the world that you own your property.

- Land carries a value and may be used as collateral or security for loans.

- A Title allows you to better plan the best use of your land.

Only parishes or areas declared for LAMP can fully benefit from LAMP services

Why LAMP II Now?

LAMP II provides a central “one stop shop” in obtaining your title at a fraction of the cost. With LAMP II, all land surveys and legal matters are dealt with in one place. Certain government Taxes and fees, such as Transfer Tax, Stamp Duty and Registration fees will be waived, so it costs you less to register or update your title. LAMP II has also implemented a payment plan to make it still easier on your pocket or you can access financing through a financial institution.

CLICK TO DOWNLOAD AVAILABLE BROCHURE

Home Swift Home (Lower down payment makes homeownership easier)

Daraine Luton, Senior Staff Reporter

THE high downpayment required in order to purchase a home is to be drastically slashed, following the passage of an amendment to the 1960 Mortgage Insurance Act in Parliament.

Fwd: News that are important to our industry

Purchasing Tips And Information Part 1&2

PART 1: Once you have identified a property of your choice, we are here to work with you throughout the purchase process from start to finish.

First, we gather pertinent information from you the purchaser(s); we use the information gathered to complete an ‘Offer to Purchase Form’ for your signature. The Offer to Purchase Form outlines the terms of the offer and serves as the basis on which the seller’s attorney prepares the Sales Agreement.

The Offer to Purchase Form is primarily used to submit your offer to the vendor. Once your offer is accepted, the Sales Agreement is signed by you the purchaser(s), and a minimum deposit of 15% of the purchase price is required at the signing of the Sales Agreement.

Buyers need the assistance of an attorney-at-law who will review the Sales Agreement and conclude the sale transaction.

NOTE: There is no binding agreement between the purchaser and the vendor until the Agreement for Sale is signed and the deposit is paid.

Once you have completed the Sales Agreement, the process to transfer the property title, payment of transfer taxes, and stamp duty is undertaken by the attorneys representing both parties period.

PART 2: The balance of purchase price is due at the closing of the sale. For purchases financed by a mortgage (financial institution), the time to complete the sale can take anywhere from three (3) months from the date of signing the agreement.

For a cash purchase, the buyer and seller determine the time period. In April 2008, Title Insurance in Jamaica was introduced. This makes the possibility for the closing time frame substantially shortened for both mortgage and cash purchases. Title insurance offers many benefits to the purchaser. All purchasers are advised to acquire Title Insurance as part of their purchase decision.

The costs of purchasing a property include:

- Attorney’s fees (approximately 3% of the purchase price)… Please contact your attorney for an idea of their fees.

- Mortgage processing fees (to be determined by financial institution).

- Government stamp duty*, Registration fees*, and Attorney fees could amount to a total of 4.5% of the purchase price. *These fees are shared equally between seller and buyer. NOTE: Please contact your attorney for specific figures.

What are the cost associated with selling your property?

Government transfer taxes = 5% of the Sale Price* Registration fees = 0.5% of the Sale Price* Stamp duty 4% of the Sale price. Real Estate Sales Commission (approximately 5% to 7%) Attorney’s fees (approximately 3% of Sale price) NOTE: *these fees are shared equally between both seller and purchaser.

HOW LONG DOES IT TAKE TO SELL A PROPERTY?

If the buyer’s purchase is financed by a mortgage from a Jamaican financial institution, the average time to complete the sale is approximately 3 months from the signing of the Sales Agreement. The period of closing for a cash purchase is determined by the buyer and the seller. The closing time for both mortgage and cash purchases can now be significantly reduced due to the introduction of the Title Insurance in April 2008.

Selling your property – How does our service works?

WE MARKET YOUR PROPERTY AT NO IMMEDIATE “OUT OF POCKET” COST TO YOU, the seller. This means, No sale, No commission! Upon viewing your property, we will conduct a market analysis and present you with a marketing strategy that outlines how we will best market your property. We utilize various marketing options to expose your property. We use such advertising mediums as newspaper advertising, website listings, signage*, open houses*, networking with other Sales Associates and real estate companies–we use other appropriate marketing strategies as necessary. We encourage you to list your property at a price competitive with other properties in the current surrounding area. We especially encourage you to list your property at a fair market price that will garner the best price as quickly as possible. After agreeing on a price for your property, we provide you with the “Multiple Listing System Agreement form (MLS)” for you to review. We create a Vendor Net out sheet that provides you with an estimate of the charges* (Gov’t Taxes, Transfer, Real Estate Fees, etc) you will incur in selling. NOTE: The figures listed on the net out sheet is provided as an estimate only.Your attorney will better able to provide you with specific figures.

Please contact our office for additional information on listing your property For Sale with us. Our team are licensed Real Estate Professionals with over 25 years experience in selling Real Estate in Jamaica and abroad. We will be happy to assist you with listing your property.

Whether Residential, Commercial, or Agricultural, Land or Building. Whatever your real estate needs, we are happy to work with you. Call our office @ (876) 631-8825 today for more information.

List your property with our company, please call us for additional information. We will market your property at no expense to you until the completion of sale.

Contact us for personal service. We are a real estate company that cares and we will do our best to market your property as aggressively as possible.

Services Offered: Sales Rentals Leases.

Pro Landlord Luxury Market

Jamaican law is PRO-TENANT, but there is a big gap between formal law and real-world practice, which in high-end rentals often ignores formal law.

Rents: Can landlord and tenant freely agree rents in Jamaica?

The Rent Assessment Board sets the rental for all commercial and residential premises.

The landlord must make an application to the Assessment Officer of the Board . The latter sends a Valuation Officer to inspect the rental property. The Assessment Officer issues a Certificate of Assessed Rent, which contains the standard rent applicable to the premises.

The standard rent is an annual percentage of the assessed value of the premises and is prescribed by the Minister . The current rent ceiling is 7.5% each year.The Board takes into consideration any increases in property taxes, improvements to the property and other related factors.

Any illegal increases in rent can be recovered by the tenant, or deducted by him from the rent.

Increases in rent are allowed under the following conditions :

• Substantial improvements or structural alterations in the premises

• Substantial improvements to the amenities, or in the locality

• Increases in rates and taxes (other than water and sewer rates)

• As may be ordered by the Minister

How effective is the Jamaican legal system?

The Rent Assessment Board receives and settles landlord-tenant disputes. In practice, the Rent Restriction Act applies mainly to low-rent housing. High-end landlords have ways of bypassing the formal law, e.g. evicting tenants by claiming the property is required for their own use.

The Board has a 95% settlement rate and hardly has to refer cases to the courts. Those that are referred to the courts mostly involve security deposits. Among the 4503 complaints received by the Board during the period of April 2003 to March 2004, 4000 have been settled, according to the Jamaican Information Service. Most complaints to the Board are about illegal increases, arrears in rental and harassment.

Landlords who have difficulty with tenants, especially on the matter of arrears in rental where tenants refuse or have not paid their rent for over 30 days, prefer to lodge their complaint to the Board rather than the court. The court is a bit tardy in dealing with these cases whereas the Board can arrange a meeting between the two parties within the next 5-6 days to settle the issue.

Enforcement of court rulings takes an average of 14 calendar days.

Legislation

Rental agreements can be verbal or written. The Rent Restriction Act of 1944 governs the relationship between the landlord and the tenant. The Rent Restriction Act is being amended to ensure the playing field is level between the landlord and the tenant.

Brief history: Recent changes in Jamaican landlord and tenant law

Since the establishment of the Rent Assessment Board in 1944 to address problems encountered by landlords and tenants, the only major change was the closure of the regional offices of the Board resulting in a backlog of cases. To address mounting concern, a new board has been formed with island-wide scope. The board will have members drawn from various parishes to prevent persons residing in rural areas having to travel to the city of Kingston. In other words, the new board aims to speed up the process of settling rent disputes and enhance convenience to both parties concerned.

In 2004 it was announced that the Rent Restriction Act will be amended to give birth to a new Rent Board tasked to strike a greater balance between in the protection of tenant’s rights (now strongly protected) and property owner’s return on investments (now weakly protected). Some of the proposed amendments are:

• Renaming the Act to reflect its new, more balanced role

• Removing rent control from public and commercial buildings

• Setting minimum standards for premises

• Legalizing security deposits

• Establishing a rent tribunal to deal with all rental cases

• Increasing fines and penalties for breaches of the Act.

A recent development in strata units is the petition of Jamaica Association of Strata Corporations (JASC) to seek jail terms for delinquent apartment owners with outstanding maintenance fees. The Association believes that the courts should have the power to force rent money to be diverted to pay for overdue maintenance fees, and be able to pursue delinquent landlords overseas. The Association also wants violations of certain strata housing regulations to be addressed, such as proprietors allowing the establishment of informal or small businesses in their units.

Ten Habits Of Incredibly Happy People

We’re always chasing something—be it a promotion, a new car, or a significant other. This leads to the belief that, “When (blank) happens, I’ll finally be happy.”

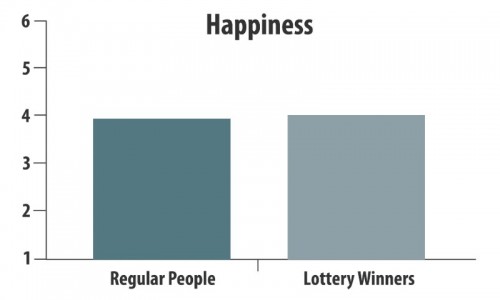

While these major events do make us happy at first, research shows this happiness doesn’t last. A study from Northwestern University measured the happiness levels of regular people against those who had won large lottery prizes the year prior. The researchers were surprised to discover that the happiness ratings of both groups were practically identical.

The mistaken notion that major life events dictate your happiness and sadness is so prevalent that psychologists have a name for it: impact bias. The reality is, event-based happiness is fleeting.

Happiness is synthetic—you either create it, or you don’t. Happiness that lasts is earned through your habits. Supremely happy people have honed habits that maintain their happiness day in, day out. Try out their habits, and see what they do for you:

1. They slow down to appreciate life’s little pleasures.

By nature, we fall into routines. In some ways, this is a good thing. It saves precious brainpower and creates comfort. However, sometimes you get so caught up in your routine that you fail to appreciate the little things in life. Happy people know how important it is to savor the taste of their meal, revel in the amazing conversation they just had, or even just step outside to take a deep breath of fresh air.

2. They exercise.

Getting your body moving for as little as 10 minutes releases GABA, a neurotransmitter that makes your brain feel soothed and keeps you in control of your impulses. Happy people schedule regular exercise and follow through on it because they know it pays huge dividends for their mood.

3. They spend money on other people.

Research shows that spending money on other people makes you much happier than spending it on yourself. This is especially true of small things that demonstrate effort, such as going out of your way to buy your friend a book that you know they will like.

4. They surround themselves with the right people.

Happiness spreads through people. Surrounding yourself with happy people builds confidence, stimulates creativity, and it’s flat-out fun. Hanging around negative people has the opposite effect. They want people to join their pity party so that they can feel better about themselves. Think of it this way: If a person were smoking, would you sit there all afternoon inhaling the second-hand smoke? You’d distance yourself, and you should do the same with negative people.

5. They stay positive.

Bad things happen to everyone, including happy people. Instead of complaining about how things could have been or should have been, happy people reflect on everything they’re grateful for. Then they find the best solution available to the problem, tackle it, and move on. Nothing fuels unhappiness quite like pessimism. The problem with a pessimistic attitude, apart from the damage it does to your mood, is that it becomes a self-fulfilling prophecy: if you expect bad things, you’re more likely to experience negative events. Pessimistic thoughts are hard to shake off until you recognize how illogical they are. Force yourself to look at the facts, and you’ll see that things are not nearly as bad as they seem.

6. They get enough sleep.

I’ve beaten this one to death over the years and can’t say enough about the importance of sleep to improving your mood, focus, and self-control. When you sleep, your brain literally recharges, removing toxic proteins that accumulate during the day as byproducts of normal neuronal activity. This ensures that you wake up alert and clear-headed. Your energy, attention, and memory are all reduced when you don’t get enough quality sleep. Sleep deprivation also raises stress hormone levels on its own, even without a stressor present. Happy people make sleep a priority, because it makes them feel great and they know how lousy they feel when they’re sleep deprived.

7. They have deep conversations.

Happy people know that happiness and substance go hand-in-hand. They avoid gossip, small talk, and judging others. Instead they focus on meaningful interactions. They engage with other people on a deeper level, because they know that doing so feels good, builds an emotional connection, and is an interesting way to learn.

8. They help others.

Taking the time to help people not only makes them happy, but it also makes you happy. Helping other people gives you a surge of oxytocin, serotonin, and dopamine, all of which create good feelings. In a Harvard study, employees who helped others were 10 times more likely to be focused at work and 40% more likely to get a promotion. The same study showed that people who consistently provided social support were the most likely to be happy during times of high stress. As long as you make certain that you aren’t overcommitting yourself, helping others is sure to have a positive influence on your mood.

9. They make an effort to be happy.

No one wakes up feeling happy every day and supremely happy people are no exception. They just work at it harder than everyone else. They know how easy it is to get sucked into a routine where you don’t monitor your emotions or actively try to be happy and positive. Happy people constantly evaluate their moods and make decisions with their happiness in mind.

10. They have a growth mindset.

People’s core attitudes fall into one of two categories: a fixed mindset or a growth mindset. With a fixed mindset, you believe you are who you are and you cannot change. This creates problems when you’re challenged, because anything that appears to be more than you can handle is bound to make you feel hopeless and overwhelmed. People with a growth mindset believe that they can improve with effort. This makes them happier because they are better at handling difficulties. They also outperform those with a fixed mindset because they embrace challenges, treating them as opportunities to learn something new.

Source: (https://www.forbes.com/sites/travisbradberry/2017/02/14/ten-habits-of-incredibly-happy-people/amp/)

https://nohuts.com/advice/2019-tax-cuts-boost-the-jamaican-real-estate-industry